Do I *REALLY* Need an LLC? The Only 4 Questions to Ask!

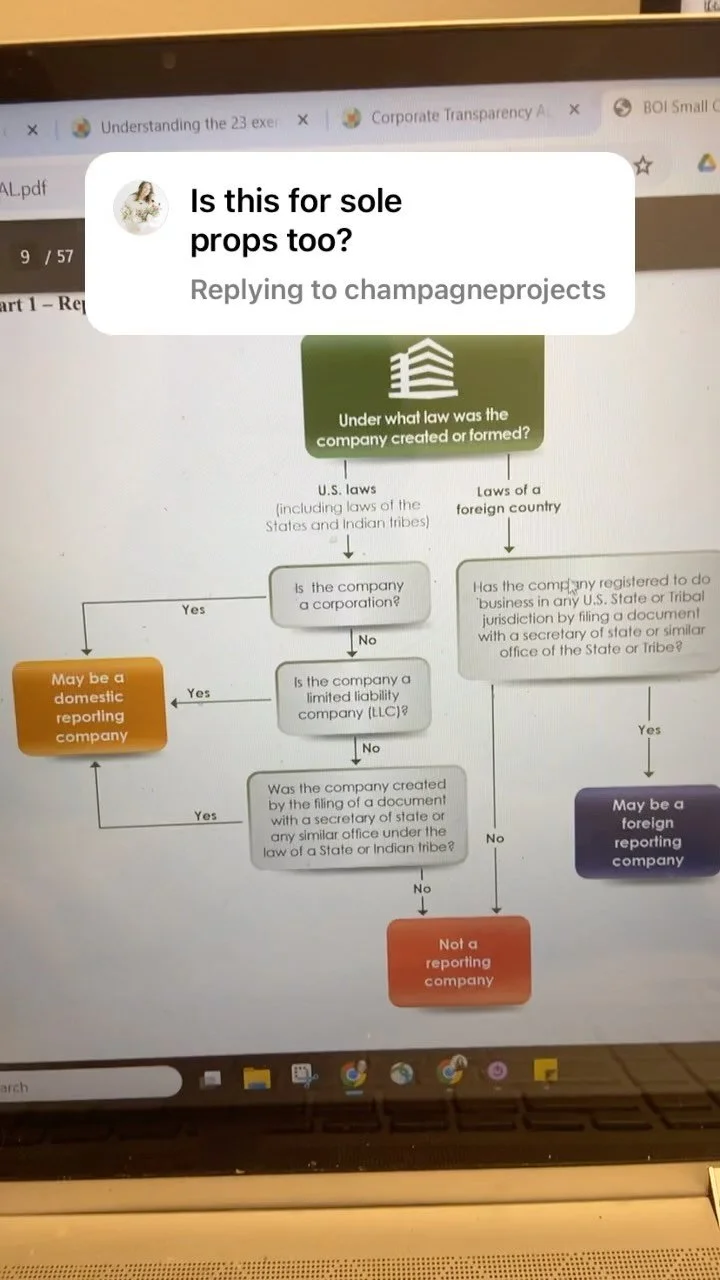

/If you're reading articles about running a small business, you've no doubt had someone tell you that you need to form an LLC (or file as a corporation. During this article, I will use these terms interchangeably, as they are similar for the purposes of this information).

But if you're a newbie event planner, photographer, florist, etc.-- do you really need to take the time to file with the state? After all, it's just you, right? And who is going to sue you for a wedding? Can't you just do it later?

Do you own stuff?

Do you own stuff..... well I mean of course you do! But what I mean by "stuff" is property. Do you own a car? Do you have a house? Do you have a savings account? These are the things that an LLC will protect if you get sued.

An LLC essentially forms another entity around you, acting as a "bubble" (For a breakdown of the protections an LLC gives you, as well as my fav gif of all time, go HERE). There's a reason that phrase, "Corporations [including LLCs] are people too!" The LLC has it's own name, Tax ID number, Bank accounts, etc. In the eyes of the law, it is its own "person".... without a soul (WOOOOO getting real deep here).

That means that if someone sues you for something that happens while you are on the job, the LLC will insulate you from the lawsuit, and your personal assets (the "stuff" you own or the money in your bank account) will be safe from the arms of the lawsuit. No grabby-grabby hands on the dollars in your personal account, your car, or your house.

What's your "Risk Factor?"

Ok, so this is related to what we just talked about, but it's kind of different.

I need you to picture the absolute worst-case scenario you've ever heard of happening to someone in your role. I'll give you some real-life examples I've had the pleasure of either working on or hearing about:

- A photographer: A drunk person trips on your $3k camera while you're packing up and breaks it. They also break their leg. And their fall corrupts the SD card inside of the camera. The guest sues you for their leg. The couple also sues you for "pain and suffering" because their photos are now missing (this actually happened).

- A wedding planner: The chuppah you helped assemble falls and bonks (legal term, clearly) the officiant on the head. The officiant sues you for negligently assembling a chuppah.

- You've grown, and have an unhappy independent contractor or employee on your hands. They sue you for literally any multitude of things they can come up with or make up-- misclassification, harassment, getting injured on the job, glue gun burns-- you name it.

- You're a wedding vendor doing a styled shoot. Your model falls off of a fence she was sitting on for a photo and sues all of the vendors for her injuries.

This is the reality of owning a business, people-- the risks are REAL. People won't just look at you and say, "oh she's cute and just starting out, I won't sue her." Folks are lawsuit happy, and you might find yourself square in the line of fire if/ WHEN (because we all do) you make a mistake.

From the perspective of my "day job" (aka putting on my lawyer hat) I can tell you that when someone sues an incorporated business, it's a lot less stressful for the business owner than when someone sues a non-incorporated individual. Why? Because suing a business limits the person's individual liability (remember, LLC= limited liability company).* Going into a negotiation where my client is a business means there's a LOT less at stake.

*so long as they are 1) separating work funds from personal funds 2) not committing fraud or something, and 3) making their yearly filing.

3. Do you have a partner in crime or are you flying solo?

One of the awesome things about an LLC or corporation is that the business can last longer than the people involved.

Huh?

Hold on to your hats here, bc we are going into the legal weeds. This means that if you're in a partnership where one partner wants out, (or gets hit by a bus) the business doesn't legally dissolve and form a new sole proprietorship. That's a weird, legal thing, but it matters in the long run (especially if there are trademarks/ copyrights involved).

An LLC or Corporate filing can also mean you plan out the division of ownership, percentage of profit, and management klout in the company through an Operating Agreement or Articles of Incorporation/ Bylaws, so there aren't any issues with THAT can of worms down the road (wanna know why I am always busy and in court? THIS IS WHY!!) Don't know what I mean? Check out our Pre-Partnership Workbook for some context.

All in all, if you're more than one person, get this ish incorporated.

4. Do you need to feel legit?

So this one isn't so much of a "legal" thing, but hear me out. The day folks get their LLC (or Corporate, if you go that way) filings is one of the coolest things to watch. I usually get local people to come into the office so I can physically hand them their certificate of filing.

Why do I carve out this time for something that can be easily emailed?

It's because the second someone sees an official, printed government filing with their business name on it, they go from "Yeah I'm kinda doing it" to "HOLY HECK IT'S HAPPENED! I AM DOING IT!" Having an "LLC" or "Inc." after your business name makes things a heck of a lot more official for potential clients as well as for yourself. And sometimes, that's the little push you need to go from "kinda-sorta-doing-it" to "killin-it-officially."

Final Words

Forming an LLC (or Corporation) is a very simple, low-cost way to protect your assets. 99.9% of the time, I advise a new business to just go ahead and file the short-and-sweet paperwork. Always consult with your friendly neighborhood attorney, because every situation is different, but when in doubt, file that LLC!