End-Of-Year Business Checklist- Let's end 2023 with a BANG (and not miss the new Corporate Transparency Act!)

/*updated for 2023 (looking at you, 2024!)!*

YOU MADE IT. You made it through wedding season. Through the holidays.

And now…. it’s ENGAGEMENT SEASON.

That time of year when we switch from one calendar year to the next…. also referred to as “the holidays” to those outside of the wedding industry.

And while this slight lull in actual event production is occurring, you’ve got to make sure you’ve closed out this decade STRONG so that 2024 will be bigger, stronger, and better than the last.

So…. what should you be doing to finalize 2023? Let’s dive in.

Pin this image to come back to this later, or to remind you for next year!

1) 2) Make sure you've paid your filing fees, sales taxes, and biz licenses.

When things slow down a bit, it's the perfect time to make sure your filings are all up to date. For example:

Take a gander at your state's corporations office to make sure you're up to date on your corporate filings.

Most localities are going to require a “local business license” to operate, which must be renewed every year. Check out your city/ town/ county website to find out how and when you need to file your local business license each year.

Make sure your sales tax figures are updated.

And remember: If you are selling a physical product (ahem, photogs selling prints and florals, this is most certainly you) you NEED to be paying sales tax on it!!

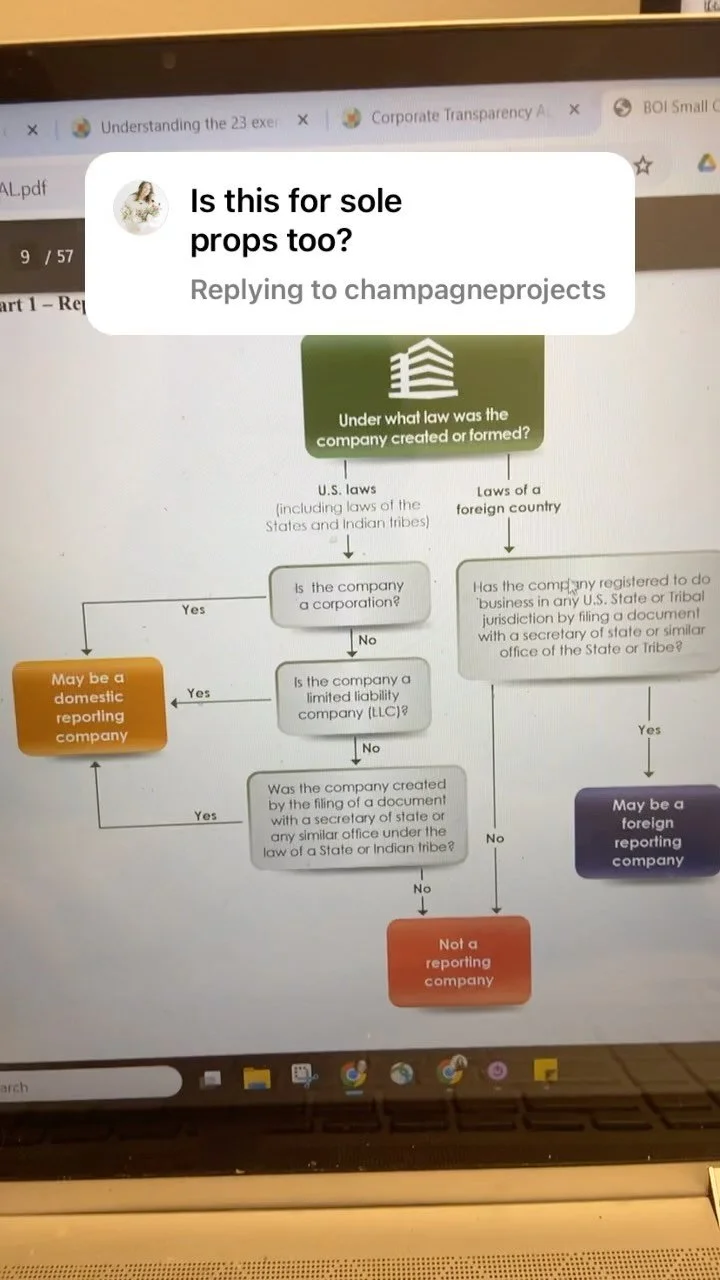

2) Get ready for the BRAND NEW Corporate Transparency Act hitting us in 2024

Yes, the rumblings are true: the brand new Corproate Transparency Act is actually happening!

What is the Corporate Transparency Act? While I’ll go in depth in a later article (sent first to our EMAIL LIST, so get on that…) Here’s a 30-second primer:

The Corporate Transparency Act, which was signed into law in 2021, represents a significant shift in the regulatory landscape aimed at enhancing corporate transparency and combatting financial crimes. The CTA aims to enhance corporate transparency and prevent the illicit use of companies for money laundering, terrorist financing, and other financial crimes. The CTA introduces new reporting obligations for businesses, and compliance is crucial for avoiding potential legal consequences. There are very few exemptions from the CTA, so your business is likely covered. You’ll have to make a filing online with FinCEN to report the beneficial owners of your company, if there are any changes, and to update your contact information.

Keep your eyes out 👀 for more info on this, and sign up for our mailing list to stay in the know!

3) Get Ready for taxes: Gather all of your receipts— and SAVE them!

I used to think that just logging my expenses was enough.

Yeahhh…I was wrong.

Keeping copies of receipts is actually really important for entrepreneurs-- especially if you get audited. So that crumbled up receipt in the bottom of your purse? That smushed invoice in the bottom of your camera bag? PULL EM OUT, SCAN and STICK EM IN A FOLDER!

And this year? Use a receipt scanning app to make your life a LOT easier. Then you won’t be carrying around 200 crumbled up pieces of paper and trying to figure out if that trip to Michaels was for your client or for your latest crafting craze. My favorite app is good old Quickbooks, because IT HAS A RECEIPT SCANNER BUILT IN. That way, you’ve got records of all those receipts for years to come—- long after the ink fades out.

3) Update your info if you've moved.

A lot of wedding businesses are home based. If you've moved, make sure you've updated your information with:

the bank,

your business credit cards,

your state's corporations commission,

your county business licensing office,

the IRS

State taxing authorities

and any other government bodies who might be trying to get hold of you.

4) Protect IP

Look into your copyrihts and trademarks. Have you had any issues with people stealing your stuff? If so, it’s time to come up with a protection strategy. Have you filed copyrights? What about your trademark? These are important for any brand, not just tech startups or brick-and-mortar locations!

And if you HAVE filed any trademark applications, that brings me to….

5) Check re-filing dates on any trademarks

Do you have any trademarks filed? It’s a good time to check up on when your “statements of continued use,” or a “Section 8 filing,” colloquially referred to as a “re-file,” are due.

Statements of continued use are due after the first 5 years (between years 5 and 6) and then every 10 years thereafter (between years 10 and 11). Unless your paying your attorney to monitor these for you, they probably aren’t. So head on over to the USPTO, look up your trademark, and find out when the next filing is due (try searching and using the TDSR tool).

6) Evaluate your contracts.

Take a good look at all of your contracts. What worked? What didn't? What terms were you constantly editing and working around? What clauses made sense before but no longer serve you? What's WAY too wordy and needs a makeover? Or, is it time to buy a new contract all together?

7) Close out any accounts receivable

“Accounts receivable” is essentially a way of saying “open invoices where people owe you money and haven’t paid you yet.”

That’s money you earned. If people owe you money, put on your big kid pants and go get it. You don’t have to go full-on debt collector (that’s actually not advisable, FYI) but make sure you’ve asserted your right to be paid. You pulled off an event for them— and now it’s time to be compensated for the labor you put in.

This will help you get a better picture of your year in review, as well. Getting that full picture can be very valuable if you’re looking to get a line of credit, bring on a partner, or sell your business at some point!

8) Review Your Privacy Policy

This is a new one, folks.

With privacy laws rolling out like a flipped-over tennis-ball hopper, it’s something to be VERY aware of. California recently passed a new privacy law, effective in 2020, and several other states are poised to follow.

And while a privacy policy has been required for quite some time, many folks are still ostriching and sticking their heads in the sand.

Don’t risk it. Look at your privacy policy (or get one in place). Is it up to snuff? Have you updated all the third-party apps, software, and add-ons you use to collect data? Do you have a way to delete user data? This is all critical stuff that is required for any business collecting user data, which includes Meta (Facebook) Pixels, Google Analytics, email gathering, and more.

What else are you doing to prepare for the new year? Leave a comment and we will pick the best to add to our list!