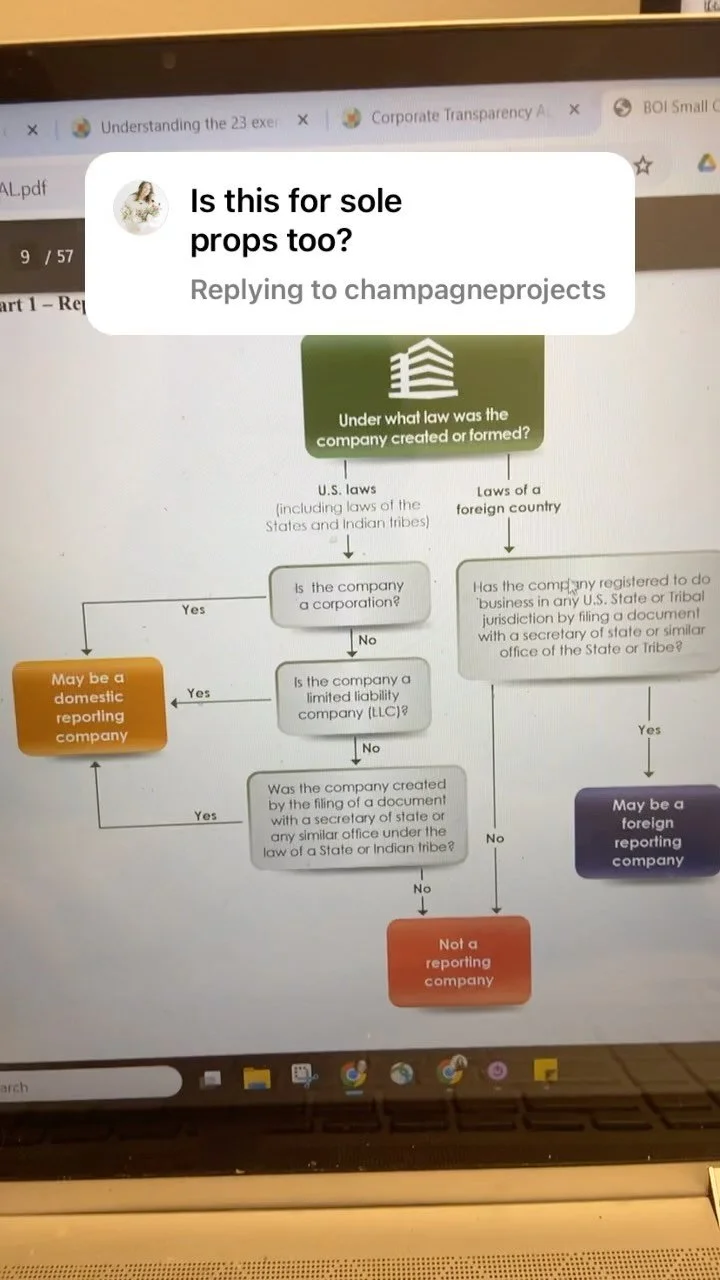

Maybe you’re a new photographer and deciding on the best way to start your business. Or maybe you’re a photographer who has been in business for a few years and who wants to add some liability protection. Your big question? What in the heck do I chose for my business entity?

The majority of the business entities we see are one of four types: Sole proprietor, Partnership, LLC, or Corporation. Each structure has its unique role, spotlighting different strengths and considerations. Read on for a quick breakdown to help you choose the perfect pathway for your entrepreneurial journey.

1. Sole Proprietorship: The Solo Act

Pros:

Simplicity: Operating as a sole proprietor is straightforward with minimal paperwork. Heck, you might not even have to file anything at all.

Full Control: You make all the decisions and keep all the profits.

Cons:

It’s all on you, baby. Personal Liability: Your personal assets are on the line for business debts, judgments against the business, or expenses incurred on behalf of the business.

Limited Growth: It might be challenging to scale your business.

If you go, it goes. If something happens to you, the business goes kaput. No legacy there.

2. Partnership: The Dynamic Duo

Pros:

Shared Responsibility: Partnerships allow for shared decision-making and workload. Someone will always be there to help in a pinch, and you’ve got build in backup!

More Resources: Pooling resources with a partner can bring more money, skills, and connections to the table.

Business Bestie; Having someone to share all the stress can be a GAMECHANGER.

Cons:

Conflict Potential: Differences in opinion or decision-making can lead to conflicts between the partners. In fact, a 50/50 partnership is the riskiest of all, due to the high chance of “deadlock”— where the partners can’t agree on something critical and the company gets “frozen” because it can’t act!

Shared Profits: You split the profits with your partner(s).

3. LLC (Limited Liability Company): The Versatile Delight

Pros:

Limited Liability: The Owners' personal assets are generally protected from business debts, judgements, expenses, or anything incurred by the business (so long as you follow the formalities of keeping finances separated!)

Flexibility: Offers a middle ground between a partnership and corporation, with many options for management structure, taxation structure, and ownership structure (equity).

Pass-Through Taxation: Profits and losses can be passed through to owners' personal tax returns, making your taxes only a tiny bit more complicated. LLCs with more than one owner will need to file their Schedule Ks— unless they elect to be taxed like a corporation, which is more complex but can provide lots of tax benefits!

Cons:

Complexity: More paperwork and formalities compared to sole proprietorships or partnerships.

State Requirements: Regulations vary by state, adding an additional layer of compliance.

“Piercing the Veil” — both LLCs and Corporations can lose their limited liability protection if the owners are “comingling funds”— e.g. mixing personal and business finances.

4. Corporations: Structured for Scale

Pros:

Limited Liability: Owners' personal assets are typically protected.

Investor Attraction: Easier access to capital through the sale of stock. Photographers typically don’t need investors, nor is it worth the investor’s time to invest in something that won’t 5x their return. For this reason, I typically don’t recommend corporations for Photographers!

Perpetual Existence: The corporation and the LLC both continue to exist even if ownership changes.

Flexibility: While a smidge less flexible than the LLC, a corporation is also super easy to customize.

Cons:

Complexity: Extensive record-keeping and regulatory compliance.

Double Taxation: Corporations are taxed on profits, and shareholders are taxed on dividends.

Choosing Your Structure: Consider Your Business Needs

If you're a new solo business owner seeking simplicity and control, a Sole Proprietorship might be your entity choice.

For a dynamic duo with shared responsibilities, Partnerships provide a collaborative platform to grow.

If you crave versatility, limited liability, and pass-through taxation, the LLC may be your perfect fit. In fact, this is where I push most of my clients for my “day job"— it’s just too good to pass up that liability protection.

For those dreaming of investor allure, the Corporation might be your best bet But for photographers? This is RARELY the best choice.

In the business world, the right structure sets the tone for success. Carefully consider your business goals, risk tolerance, and growth plans to choose the structure that aligns best with your entrepreneurial vision when starting your business. 💼✨

Ready for the next step? Try This Article: Six Steps to Legally Starting your Wedding Business!