Independent Contractors: What they REALLY are and Why the Government is cracking down

/UPDATED 11/5/2021

Did you know-- despite what you call them-- that your Wedding & Event Biz's “independent contractors” may actually be employees?

Say whaaaaat?

Yep. And misclassification can have some pretty tough consequences for both the company and the worker, including fines, back wages due, reimbursement for overtime and minimum wage payments, payment of back taxes, fines for state income taxes, and more. So in this "1099 Economy," how do we know who is what anymore?!

It’s alllllllll about control.

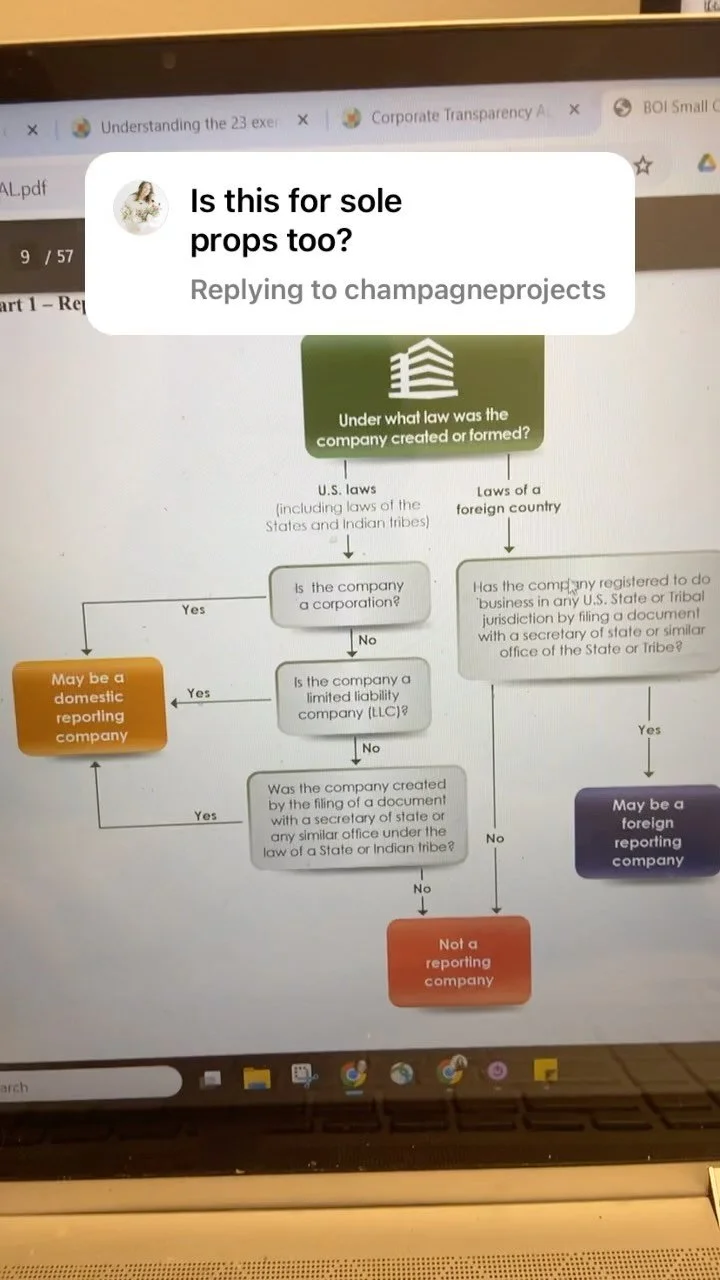

The IRS 20 factor test is a helpful guide to the basics of determining whether a worker is an employee or independent contractor. These factors are focused on the overall control exerted by the hiring party over the worker. But to many folks' confusion, there is no magic number of factors that automatically make a worker an employee vs an independent contractor. And some factors relevant in one situation may not be relevant in another! WHEW they're trying to make it hard on us!

Some of the more weighted factors?

Independent Contractor: Paid in a lump sum for the project

Employee: Paid hourly rate

Independent Contractor: Can set own hours and may work from own space

Employee: Works from an office; works set hours

Independent contractor: Comes with own knowledge, tools, materials, supplies, and training

Employee: Uses hiring party's tools and materials, is trained by the hiring party

Independent Contractor: Hires own assistants/ "helpers"

Employees: Assistants to the worker are hired by and paid directly by the hiring party,

Independent Contractor: Work is limited and project-based

Employee: Works routinely for the hiring party

Independent Contractor: Can work on selected projects, can refuse projects, and can work for other competing businesses to the hiring party.

Employee: Worker must devote substantially all their time to the performance of services for the hiring party. Non-competes are big here. Generally, if someone is signing a non-compete, they are probably in or very close to employee territory!

Independent Contractors: No benefits provided

Employee: Can provide benefits, may have to provide health care and unemployment, may have to withhold money for taxes, etc.

In a nutshell? The more control the employer exerts over the worker, the more likely it is that the relationship is that of employer-employee.

Why is it important?

If you're the worker, whether you are an independent contractor or employee is an extremely important distinction. Why? Because as an independent contractor, you are considered self-employed for tax purposes. This means you are personally responsible for filing and reporting requirements, which also extend to any subcontractors you hire. You should be filing quarterly taxes (a handy calculator can be found here!) or you might get hit with a hefty bill come April.

As an employer, it is critical that you determine whether your workers are independent contractors or employees. The Department of Labor (DoL) and the IRS have recently increased scrutiny and enforcement relating to employers treatment and classification of workers. Consequences for misclassification can result in fines, back wages due under the Fair Labor Standards Act (FLSA), reimbursement for overtime and minimum wage payments, payment of back taxes and fines for state income taxes, Medicare, Social Security and unemployment, payment of workers’ compensation benefits, and provision of benefits like health insurance to newly classified employees.

What Can Business Owners Do?

Don't panic. This is a very common problem, as many companies have misclassified workers for a long time. The IRS has set up a program to help well-meaning business owners get right with the law called the "Voluntary Classification Settlement Program." You can apply for this program if believe you may have, misclassified employees for a minimum of three years. You submit this form to apply. If eligible, this program affords partial relief from federal employment taxes for taxpayers who agree to, going forward, treat their workers as employees. Definitely consult with an attorney before undertaking this step. There may be additional information you need to know, and you may need to take similar steps within your state

.

Similarly, proper contracts clearly laying out the responsibilities of both the worker and the employer is an important step (I know of a great one here!). Your contract should address specific information about the factors written above, including that the worker is considered an independent contractor, specify the party responsible for tax reporting, state that the manner and means of working are up to the independent contractor, etc.

Need a breakdown of the IRS 20 Factors test and the ABC test? WE GOT YOU! Grab our free guide right here!

If you need a referral to an attorney who works with creative professionals in your state, email us-- we've got a list going and are happy to refer you!