LLC vs. a Business License- What's the difference?

/I get this question at a lot of conferences, so I thought it was high time we cleared this up!

The answer is a surprisingly simple one. A business license and an LLC are very different, from completely different government agencies, and serve different purposes. I think people get them confused because a) they are usually completed around the same time, and b) you would think that branches of the government would talk to each other.

SPOILER ALERT: They don't talk at all!

Here's the quick and dirty on the difference:

1. An LLC means that you've filed an application to make your business a limited liability entity. You have essentially asked the state to create a "bubble" out of your business that will protect your personal stuff-- money, cars, your house-- from business-related issues, missteps, or problems.

A good way to think of it is that you get a state-sanctioned bubble-soccer outfit.

This bubble will only "pop" (you lose the personal protection) if you do certain very "sharp" things-- like commit fraud, (probably obvious) or co-mingling your funds (not super intuitive). Co-mingling funds means mixing personal and biz money. So get a separate bank account, and don't fund your shoe-buying habit from your business account!

An alternative to an LLC filing would be to file as a corporation, a limited partnership, or other limited liability entity. You'd still get that layer of protection, but it would look slightly different structurally.

2. A business license, on the other hand, is something you get from your city, town, or locality. Your business license is just that-- a license to do business in a certain area. It's simply the city/ town/ locality saying, "Hey, we know you're here, you can operate here if you pay us $30 per year in taxes" (or whatever your area's rate may be).

You get a business license from your area's City Hall, Business Division, or other business-related body. You may need to contact your local Chamber of Commerce to find out exactly where to go. And guess what? Some localities don't even require a business license, so you might just luck out if you live in one of those areas!

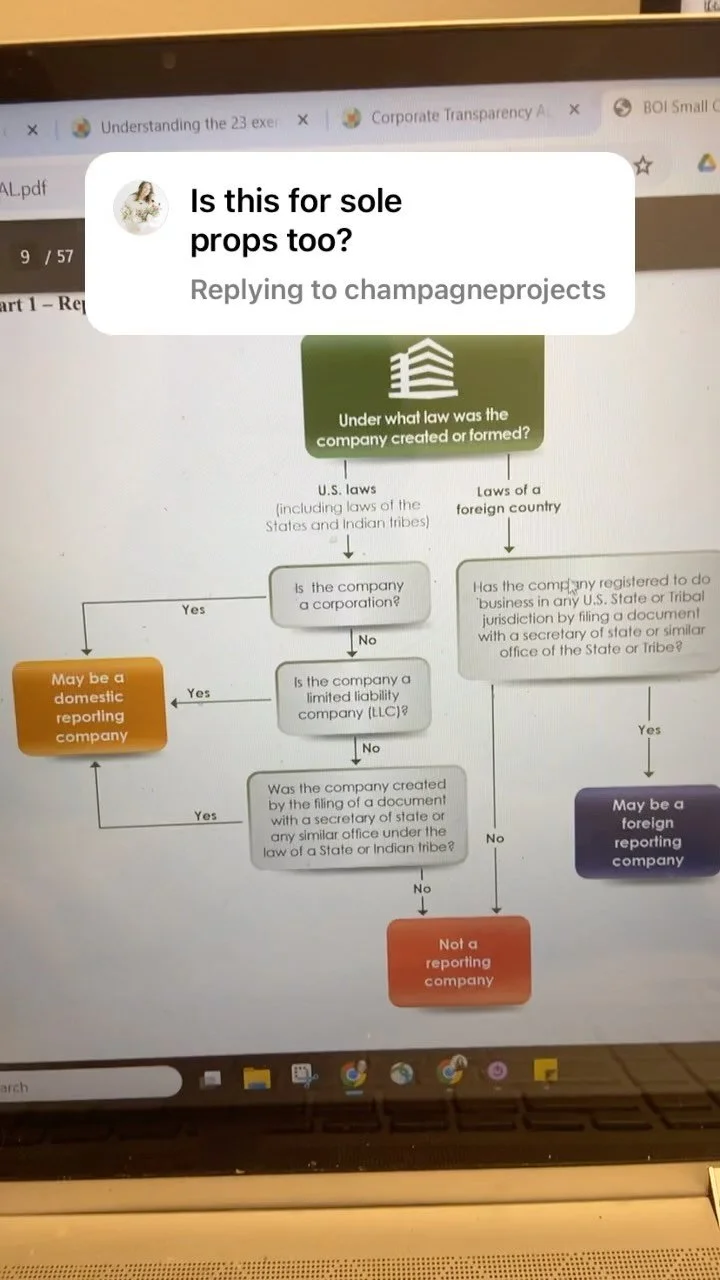

3. Why you need both independently of each other: You might be thinking to yourself, "Oh, I file both of those with the government. They talk right?

Wrong.

The city/ town/ locality and state don't talk. At all. Unless it's about them getting money, and then they might communicate. Anything else? Kind of a lost cause.

You have to think of them as existing in separate bubbles— the corners of that Venn diagram just don’t cross 😆

This means filing just your corporate paperwork to become an LLC won't get you a license to do business in a certain location. Doing business and getting a business license while calling yourself an LLC won't make you a real limited liability entity. You have to file both filings in both places to get it all done correctly.

Make sense? If not, your friendly neighborhood attorney or the local Chamber of Commerce or Small Business Administration should be able to point you in the right direction!