4 Reasons Being a Sole Proprietor is a Bad Idea for Wedding Pros

/A lot of times, wedding pros plan to "start out small" in their business. This means running lean and on a shoestring budget. And lots of times, these are the folks who skip the corporate formation step and just opt to be a sole proprietor (an "SP").

Let me tell you-- this could be one of the most expensive mistakes you make.

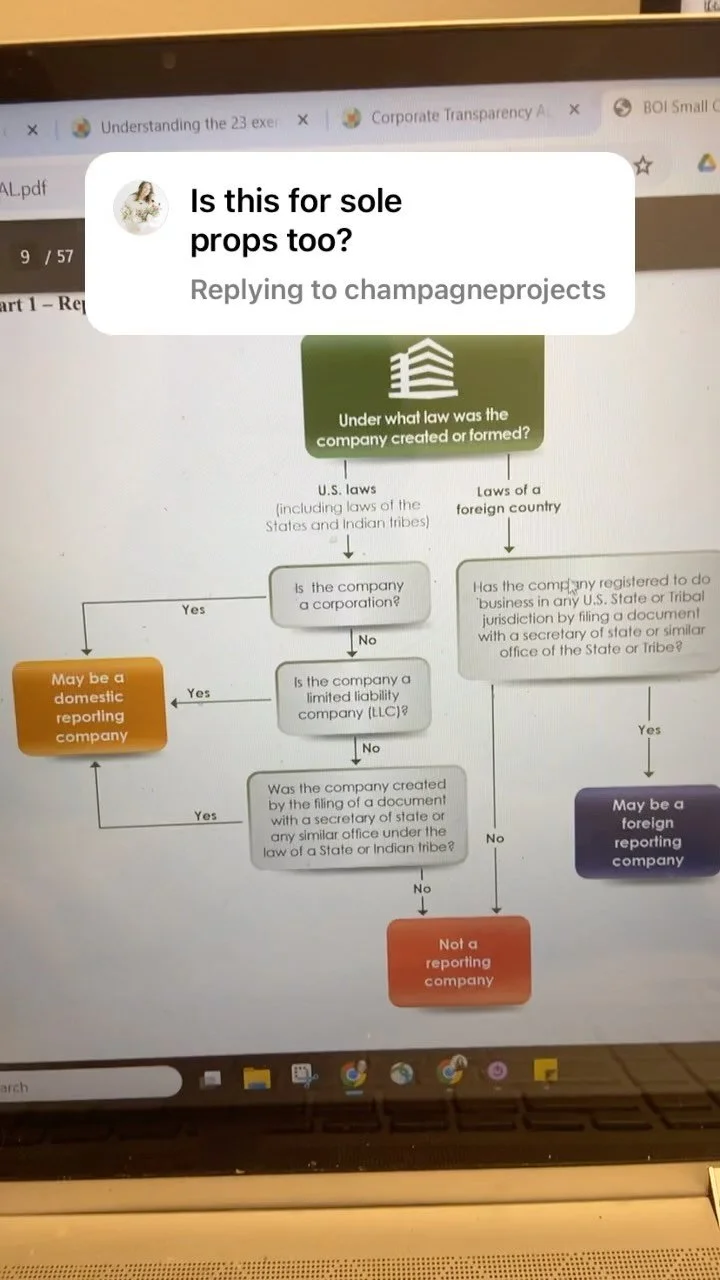

How does one become an SP?

Let's start with how an SP is formed. You decide to advertise or sell a product or service for your own business. BOOM. You're a sole proprietor. Nothing else is required.*

Sounds easy, right?

And it is. Technically, little Suzi Q on the side of the road selling lemonade is a sole proprietor! If you start a blog, start a photography business, set out as a wedding planner, begin selling floral arrangements-- you've become a sole proprietor.

But with that simplicity comes a whole lotta risk.

Liability, Liability, LIABILITY.

When you're a SP, you and your company are very intertwined. And while that makes some things easy, it can create a MESS if you get sued or are otherwise subject to a judgment. If an opposing party or creditor gets a judgment against you, and your business doesn't have the $10k in the bank to satisfy the award, then the opposing party can reach into your "personal" accounts to get their money. Opposing parties can go after your personal assets-- your car, house, kid's college fund, trip-to-Tahiti-savings, etc.-- if you're a sole proprietor. Similarly, if your company goes bankrupt, you will have to file for personal bankruptcy as well. All of your assets will be considered together. This is probably the number one reason to avoid being a sole proprietorship, and the one that gets talked about the most.

And if you think you won't get sued, think again. With the average cost of a wedding at around $30k, some bride- or- groom-zillas will do anything to save a buck.... or get some bucks back.

With a corporate entity like an LLC or corporation, you get a protective "bubble"-- like one of those bubble-soccer suits-- to help protect you and your personal assets. Your personal assets and your business assets (equipment, IP, loans, bank account) will be in separate containers-- and the creditors can't reach across to grab assets from one container to satisfy the other.

ranted, you can "pop" that bubble if you run into something "sharp" enough-- co-mingling funds, sham entities, fraud. BUT-- it is difficult for an opposing party to "pierce the corporate veil" if you play by the rules-- which isn't difficult, especially with an LLC!

If you're looking for loans or investors, you're outta luck.

I have never once seen an investor capitalize a sole proprietorship. Never. And I can't say it doesn't happen, but it's rare.

Why? Think about it. If a company can't be bothered to file a piece of paper every year, how on EARTH are they going to run a business that's worth investing in?

Maybe you're not worried about investors. But one day, you might want to open a studio. Buy a building. Sell your company. And for any of these things, 99% of the time you will need to have a corporate entity in place.

You die, it dies.

With an SP, if the proprietor dies, the company dies. Also, if you add a partner, transfer ownership, etc, it is "reborn" (more on that later). There's no "perpetual duration" here. Why? Because the business and the person are-- for all intents and purposes-- one-in-the-same. That means on top of your death, your family would have to deal with liquidating a company-- not a fun process.

Plus, if you want to build an empire-- maybe you should ensure it lasts beyond your rule. Just a thought.

The Eye of the Beholder: Just Looking Like You Have Your Ish Together.

How many times have you heard "fake it til you make it" in business? Or how important it is to present yourself well? If you've ever watched Shark Tank you know you get ONE SHOT at impressing potential client, and to show them you've got what it takes to execute the event of a lifetime/ photograph or video for their big day/ create masterpieces for them/ make them look like a straight goddess.

And while it takes just a small amount of work, (which we detail in our 90 min Wedding Biz 101 Workshop, BTW) that "LLC" or "Inc." at the end of your name can have a big impact.

Just think about it: What looks more legit--

Florals and Fauna

or

Florals and Fauna, LLC

The second one, right? And that makes you stand out to potential clients in an increasingly flooded market. Sometimes, all it takes is a little superficial "oomph" to show that you are on top of it all.

*NOTE: In most states, this is a "default" formation, meaning no paperwork or filings are needed. State laws may vary, however, so check with an attorney licensed in your location. Also, remember that to do business legally in your locality, you may need to file a business license application with your city/ county.